Research Studies Series No. 1

Improving the Orchestra’s Revenue Position: Practical Tactics and General Strategies

Arthur C. Brooks

Research Studies Series No. 1

Symphony Orchestra Institute

Evanston, IL USA

Improving the Orchestra’s Revenue Position:

Practical Tactics and General Strategies

Arthur C. Brooks

Research Studies Series

No. I

Symphony Orchestra Institute

Evanston, Illinois USA

The mission of the Symphony Orchestra Institute is to improve the effectiveness of symphony orchestra organizations, to enhance the value they provide to their communities, and to help assure the preservation of such organizations as unique and valuable cultural institutions.

Publications in the Research Studies Series present insights based on scholarly research and analysis typcially focusing on particular dimensions of symphony orchestra organizations. These research-based publications are written especially for communication with symphony organization practitioners: staff and orchestra employees, volunteers, and others closely involved in the operation and funding of orchestral organizations.

© 1997 by the Symphony Orchestra Institute. All rights reserved. No part of this study may be produced or utilized in any form or by any means, electronic or mechanical, including photocopying or recording, or by any information storage and retrieval system, without the permission in writing of the publisher. Reprints may be requested from the publisher.

Preface

In fall 1995, the Symphony Orchestra Institute initiated a research program by requesting doctoral research proposals especially centered on certain areas of symphony activity, including “organizational economics.” In early 1996, the Institute awarded a grant to Arthur C. Brooks, a doctoral student at Cornell University, to advance his research on the characteristics of demand for the products of symphony orchestra organizations. That fall, Arthur transferred to the RAND Graduate School of Policy Studies at the RAND Corporation in Santa Monica, California. He completed his Institute-sponsored research in 1997 .

Based on his research, Arthur has prepared the following paper especially for Institute publication. For those who regularly grapple with the financial management of symphony organizations, it will come as no surprise that there are some unique economic factors at work within these institutions. In lay language, Arthur describes economic theories which especially relate to symphony organizations, and outlines approaches these organizations might take to enhance their wellbeing.

This paper is the first of the Symphony Orchestra Institute’s Research Studies. This series will present insights based on scholarly research and analysis typically focusing on particular dimensions of symphony orchestra organizations. These publications will be written especially for communication with symphony organization practitioners: staff and orchestra employees, volunteers, and others closely involved in the operation and funding of orchestral organizations.

Arthur Brooks holds a B.A. from Thomas Edison State College in New Jersey and an M.A. from Florida Atlantic University, both in economics. He will complete his

Ph.D. in Public Policy Analysis at RAND in July 1998. A French hornist, he played professionally for I 2 years with various ensembles including the Annapolis Brass Quintet and the City Orchestra of Barcelona. He performed in many summer festivals and also as a soloist, and served as professor and performer at the Harid Conservatory in Boca Raton, Florida

The product of Arthur’s Institute fellowship, the monograph “Economic Strategies for Orchestras,” has also been published by the Institute. Copies are available to serious students of the economics of symphony orchestra and performing arts organizations. Please direct requests for copies to the Institute’s office or to the author. This monograph provides the central material for Arthur’s doctoral dissertation,

“Four Essays on Arts Policy.”

October 1997 Paul R. Judy, Founder & Chairman

Many financial approaches have been tried over the past 50 years to improve the financial condition of orchestras. Yet, the industry as a whole appears to be in the worst shape it has ever been in ….

The Wolf Report, 1991

Introduction

The statement above won’t appear particularly extreme to many people in the orchestra business; the received wisdom is that times have been tough for many orchestras lately and are only going to get tougher. Most of this wisdom proceeds from anecdotal evidence: the death of an established orchestra, for example, or the grim prophecy of an arts administrator facing state funding cutbacks. Some of it comes from more reliable sources, however. For example, the Wolf Organization’s

The Financial Condition of Symphony Orchestras (a comprehensive study of the state of American orchestras, commissioned in 1991 by the American Symphony

Orchestra League and popularly referred to as the Wolf Reporlj reveals that, in the largest U.S. orchestras, deficits grew on average by almost 30 percent per year between 1986 and 1991. On a more theoretical level, last year William Baumol (a foremost expert on arts economics) described how economic theory predicts that, in the absence of important changes, things will tend to get worse financially over time for performing arts organizations, including orchestras. 1

Without denying that there is indeed trouble in the orchestra business, this article is guardedly optimistic: I will maintain that a lot has not yet been tried in the struggle to keep revenues abreast of costs, and I will outline some research suggesting new approaches to doing so. In addition, in contrast to much of the rest of the literature in this area, I will focus primarily on the consumer, not the producer.

The research described in this essay is intended as a truly cross-disciplinary effort, wedding my firsthand knowledge of the industry (gained during years as a performer in orchestras and chamber music) with orthodox economic principles.

Before I continue, motivation for such research bears a brief discussion. Traditionally, a serious problem with much work in arts economics has been a lack of cognizance of the unique characteristics of the markets in which arts firms operate: analysts of arts economics have often fallen into the trap of treating firms such as orchestras as if they were engaged in traditional manufacturing efforts. This can lead to inappropriate assumptions and erroneous results.2 The research presented here seeks to avoid these pitfalls: the markets described are calculated to faithfully represent the salient features of the unique reality orchestras face. Only thereafter is economic analysis applied.

Considering the common trap described above, a legitimate question arises. Why do arts firms behave unlike other organizations which are the subject of standard economic theory? There are two main reasons, I believe. First, a culture in these industries (which is beginning to change) has traditionally, consciously, kept its lofty goals relatively uncontaminated by market signals, and public arts policy has generally engendered this culture. Secondly, the ill·defined nature of the products of orchestras (as will be explained below), as well as the way markets can “fail” for these products, leads to large structural differences between an orchestra and, say, a steel factory.

The complexity of orchestra culture, products, and markets (as well as management’s frequently inappropriate responses to complicated market signals) has provided more than ample subject matter for this research, for several prior projects by this author, 3 and for other past and future research efforts by arts industry practitioners with training in economics and policy analysis. As already mentioned, such true interdisciplinary research in this area is needed to produce analysis, predictions, and suggestions for managerial practice that both communities (arts practitioners and economists) will find credible. Of course, this kind of research also poses a fascinating intellectual challenge

The next section of this paper looks at the economic problem presented at the outset in a bit of analytic depth, followed by a description of traditional remedies for the problem. The third section introduces a new perspective on how to combat the problem, as well as some tested tactics. The fourth section presents some general strategies orchestras can employ toward this goal.4 In the last section, conclusions are summarized and some suggestions for managerial practice are offered.

The Problem and Some Traditional Remedies

Simply put, the economic problem that orchestras face is that deficits seem to want, inexorably, to rise. To maintain the scale of operations traditionally enjoyed, orchestras find that they must borrow more, draw down endowments, or seek cost concessions from players. Why is this? Some suggest that certain elements of modern life just naturally work against the symphony orchestra’s ability to generate sufficient income.

Maybe so. For one thing, technological advances have created relatively inexpensive products (COs, VCRs, and soon DVDs) that are unambiguously better than the substitutes for live performances that preceded them (such as LPs). However, it can also be argued that the advent of these affordable technologies should create a new audience for “the real thing “; after all, casual observation tells one that most converts to great music begin with recordings and graduate to concert tickets (since the real connoisseur usually acknowledges that there’s no substitute for a live concert). On balance, the impact of these technologies is probably negative (from the orchestra’s point of view), but it would be hard to argue that they are solely or even principally responsible for the problem.

Others explain revenue shortfalls by pointing to recent trends in state funding that are unfavorable to orchestras. But this ignores the fact that state intervention in the arts in this country is a relatively recent phenomenon: the NEA didn ‘t even exist until 1965, yet the economic troubles of orchestras certainly seem worse today (in the presence of some state subsidies) than they were 40 years ago (when there were none).

Another view holds that people are less cultured or educated than they were 20 years ago. The anecdotal evidence is one-sided here: we’re constantly treated to news stories about ninth graders who can’t find Canada on a map, and it certainly doesn’t require much attention to notice that students’ exposure to the great pillars of Western culture isn’t as high a priority as it once was. However, inspite of all the hand wringing, the percentage of the population that graduated from college increased by about 4 8 percent from 19 7 5 to I 99 5. 5 The quality of this education and its cultural content are valid points of argument, but the issue certainly isn’t black and white.

Economics offers another explanation, sometimes referred to in the literature as “cost disease.” While considerably less sensational than the other alternatives discussed, this notion provides a convincing elucidation of what might be going on here, and is supported by considerable empirical evidence. In a famous article published in 1965, William Baumol and William Bowen hypothesized that performing arts firms would tend to see their costs rising faster than prices in the economy in general. So, for instance, performing arts firms’ ticket prices would increase more slowly than the wages firms pay out over time. More recently, economists have used the term “cost disease” to refer to the increasing gap between revenues and costs (as opposed to prices and costs). Over time, as costs increase more than revenues, cost disease leads to shrinking profits or growing deficits.

Note that so far only a symptom has been described: orchestra costs exceed revenues. The real heart of the cost disease theory goes beyond symptoms to explain why this occurs. Baumol and Bowen’s explanation posits an inability of performing arts firms to enjoy productivity advances relative to the rest of the economy. The argument (simplified here, but in spirit the same) goes like this: it takes 8 5 people 40 minutes to produce a live performance of a Brahms symphony,just as it did 125 years ago when the piece was written. In other words, because of the nature of the product (a live concert), orchestras have not really seen increases in labor productivity. At the same time, however, the development of strength· and intelligence-enhancing technologies in other parts of the economy have created huge increases in labor productivity-by thousands of percent since the time of Brahms. Economic theory predicts that since people tend to be paid that which they “earn” for the firm, their greater productivity will bring them higher real wages. For orchestras, this means the following: wages in the general economy (outside of the orchestra) tend to rise with productivity, putting upward pressure on wages all over the economy, including in orchestras. (In the absurd limit, if wages dropped enough, people would not choose to make their livings as musicians, and orchestras would disappear.) In orchestras, however, these higher wages aren’t compensated for by higher revenues, since musicians’ productivity hasn’t changed. The net result is costs which, relative to revenues, creep up over time.

There are a number of traditional remedies for the cost disease problem. First of all, productivity advances may not be impossible. Acoustic technology and recorded music would seem to promise a dramatic increase in productivity for the 85 musicians-an insight not lost on many orchestra administrators (even if rarely expressed in these terms). If concert halls can serve more listeners at once, or one recorded performance can provide millions with a “concert,” then the orchestra is in a sense more productive.

The trouble with these remedies is two-fold. First, one can argue that live, unrecorded performances are fundamentally different from those produced by these technological advances. Certainly a recorded performance differs qualitatively from a live one in a concert hall, as does one performed in a football stadium. But more importantly, for the vast majority of orchestras, consumer behavior itself tends to render such remedies futile. Only a small handful of orchestras can actually sell enough records to constitute an advance in labor productivity (that is, can more or less break even); this is known in economics as a “superstar” market.6 And frankly, for most orchestras, the problem isn’t a hall that is too small-it’s getting people into the seats that currently sit empty

Another traditional remedy has involved public funding: since costs are rising more than revenues, government subsidies can pick up the slack. The trouble with this is that, given cost disease as theoretically described, this gap should continually widen over time, meaning that subsidies also would have to grow unceasingly.

Whether this is indeed the case is a subject of debate among economists, but there is one thing one can be confident of: the amount of money needed to fill the gap isn’t likely to shrink over time, all other things remaining constant. And at present we’re hardly experiencing a renaissance of government profligacy in this kind of social spending. In other words, this is not a remedy orchestra administrators can comfortably count on into the future.

If technological and government solutions won’t work to keep most orchestras running at a desired scale of operations, is there any other solution? Recall that what defeated technology as a remedy was insufficient demand It makes sense, then, that increased public demand for concerts could help relieve the problem.

Greater demand increases revenues, and might ultimately drive up ticket prices.

And the cost of filling currently empty seats in the hall is negligible.

However, accomplishing increased demand is easier said than done. After all , solutions (on the demand side) to the cost disease problem have not been ignored by orchestras, as the recent preoccupation with marketing in the orchestra industry attests to. The problem for most orchestras has been a lack of results. However, I believe and will argue here that demand-management failure is not inevitable; rather, demand expansion simply needs to be pursued appropriately, as defined by recent economic research. 7

With this challenge in mind, I pose and answer four questions in the next few pages. First of all, it is necessary to back up a little from the implied conclusion of the preceding paragraph and formally ask the question that first motivated this research: Can orchestras influence in any real way the behavior of consumers toward their product? Second, can any specific tactics for doing so be identified?

Third, more generally, can any demand-increasing strategies be integrated into day-to-day operations? And finally, do these tactics and strategies vary in effectiveness based on an orchestra’s individual characteristics?

Increasing Demand for the Products of the Orchestra:

Practical Tactics

Before continuing a discussion about “demand,” I should clarify what exactly is being demanded of orchestras by consumers. It has been argued that the orchestra produces three products jointly:8 one that is tangible(music, broadly defined), and two that are intangible. The intangible products are the private benefits (nonmaterial, most likely) that donors receive in exchange for their charitable philanthropy; and the cultural benefits that society receives from the production and consumption of the orchestra’s music. Payment for each of these products can be measured in terms of (respectively) concert revenues, donated revenues, and tax-supported revenues.9 Economic theory shows that an increase in the demand for these products will stimulate orchestra revenues; increases in these revenues provide an indirect measure of success in expanding demand. 10

To answer the first, most fundamental question of whether an orchestra cann manipulate consumer behavior, one must consider tools (tactics) that might affect revenues. The tools treated here are certainly not exhaustive; most notably, none of them would affect the number, type, or quality of concerts performed by the orchestra. While the presentation of more, different, or better concerts might affect consumers’ decisions to attend more concerts or to act more philanthropically toward the orchestra, the principal impact of this tack would probably be on the nature of the products themselves. For this reason and for technical reasons explained elsewhere, these tools are neglected here. 11

Instead, expenditures on orchestra can control, which impact the desirability of at least one of the orchestra’s products, and which only work through the actions of consumers, will be examined. Specifically, three tools can be identified that have an effect on information about the products. Orchestras can expand demand by disseminating a reproduction of the tangible product-music-beyond its original audience (expenditures on broadcasting/recording) or by attempting to make the product more attractive and draw in new consumers (expenditures on advertising and expenditures on fund raising).

In the case of broadcasting and recording expenditures, it was suggested above that in the case of all but a handful of orchestras, radio and television broadcasting and record-making create an apparent net loss-there is no substantial market for these products. However, the story doesn’t stop here.

Broadcasting and recording can also function like publicity; they can raise the profile of the orchestra, making the consumption of its products more attractive for reasons of status. Contrary to the opinion that the continuous proliferation of recordings of the “standards” is irrational or silly, 12 yet another orchestra’s unsellable recording of the Brahms symphonies might fit into a rational plan to increase its total ticket and donated revenues. Advertising should also have a positive effect on demand by informing new consumers of the orchestra’s products. It might also increase demand by publicizing the prestige of attending (or donating to) the symphony. Fund raising should have influence similar to that of advertising, but in opposite strength. While fund raising may inform and bring in new concert goers, its principal impact would probably be on the status of donors. This is simply because fund raising is generally not geared toward generating an audience.

To answer the first question (Can demand be expanded by the orchestra?), it’s useful to find out whether changes in the tools under consideration (expenditures on recording, advertising, and fund raising) have any positive effect on the three types of orchestra revenue. In addition, in answer to the second question, this information would indicate the relative effectiveness of each tool. A statistical technique called multiple regression analysis was used to measure the separate effects of certain variables (in this case, the three tools) on another (total revenues). To use this technique, however, data on orchestras were needed.

The best and most detailed data for this purpose are collected by the American Symphony Orchestra League (ASOL). Each year, the ASOL sends out about 570 questionnaires called the “Season Orchestra Statistical Report Form” to member orchestras. It typically receives around 220 responses. About 80 percent of larger orchestras respond. Data pertaining to the three tools can be taken directly from this questionnaire; the following are the 1994-1995 entries that correspond to each:

Total broadcasting (radio and television) and recording expenses;

- Total development and fundraising expenses;

- Total advertising, promotion, and marketing expenses.

- Not surprisingly, revenue measures can also be found in the questionnaire.

- Corresponding entries are:

- Total earned concert income;

- Total private support;

- Total tax-supported grants and allocations.

These data were collected in two ways. For a large number of orchestras, the original ASOL data were not accessible, although a data set of average values across five large groups of orchestras was readily available in the Wolf Report. The groups were assembled as follows:

- The largest 19 orchestras, with 1991 budgets of $8.5 million to $38.7 million;

- Orchestras with 1991 budgets of $5 million to $8 .5 million;

- Orchestras with 1991 budgets of $1 .8 million to $5 million;

- Orchestras with 1991 budgets of $.63 million to $1.8 million;

- Orchestras with 1991 budgets of up to $630,000.

Values were given for the eight-year period 1984-1991 .13 The second data set used was from 1983-1994, for four major American orchestras (consisting of responses to the ASOL survey questions described). Each of these orchestras belonged to the largest budget category above.

I describe in detail technical difficulties presented by these data in Brooks [ 1997 b ].

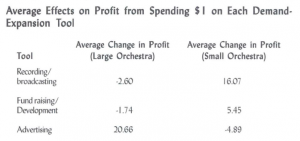

Nevertheless, the data yielded some very interesting results. Separate statistical tests were conducted for the largest orchestras (the four major orchestras and the top two Wolf Report groups) and the smallest ones (the three bottom Wolf Report groups). Test results are presented in the table below. For large orchestras as well as for small ones, the number in each cell corresponds to the total effect on profits resulting from investing an additional dollar on each of the three tools. 14

Unambiguously, this table answers three of the questions posed at the outset of this article. First, orchestras clearly can affect the behavior of consumers, according to three examples in the table. Second, these specific tools can be very effective for increasing demand (and therefore increasing revenues relative to costs). Third, this effectiveness depends strongly on the orchestra ‘s size.

In this analysis, many factors were held constant to gauge the impact of the tools on revenues as accurately as possible. It can be stated with reasonable confidence that a dollar spent on recording or advertising by large orchestras had a sizable positive effect on profits. At the same time, for small orchestras, a dollar spent on fund raising had a large positive effect on profits. In the other cases (large-orchestra spending on fund raising; small-orchestra spending on recording and advertising), impact is negligible or actually negative.

Why might fund raising be such a good investment for smaller orchestras?

Many of these orchestras became full-time professional organizations in relatively recent times (within the last 30 years or so). As such, not too terribly long ago, many did not occupy the same place they do now in their cultural communities.

Thus, it makes sense that the relative youth of many of these orchestras as cultural institutions puts them in a position to collect low-hanging philanthropic fruit.

A tougher question is, why do dollars spent on recording and advertising by these smaller orchestras yield negative returns? The answer is straightforward: money spent on recording and advertising “crowds out” money spent on fund raising, which has has been shown, is very effective. Thus, the orchestras lose a significant amount of revenue when they don’t invest in fund raising, and this amount is not entirely earned back from an investment in advertising or recording.

There is an analogous explanation for the finding that large orchestras tend not to earn back dollars spent on fund raising. Predominantly, large orchestras are located in sizeable urban areas and have long histories in their communities. It can be argued that, to some extent, they have tapped out the philanthropic dollar, while the potential for audience expansion, given their large population bases, is substantial (hence advertising and recording are profitable investments).

This is a powerful conclusion: large and small orchestras have extremely different prescriptions for affecting the behavior of consumers (who buy tickets, donate money, and contribute via their taxes to the orchestra), and picking the right investment is very important. In the case of the limited list of possible tools examined here. for example, the data recommend that smaller orchestras spend the larger part of their promotional budgets developing donors, while larger orchestras should advertise their products and record . Furthermore, if one believes these data, the penalty for not following these instructions is (on average) very harsh.

A caveat: the data used here aggregate across a large group of orchestras. All of us who have worked in the orchestra business know that individual orchestras, like their constituent regions, are very different from one another, so the “average” effect of a particular tool on profits might differ substantially from actual effects in a certain orchestra, large or small. This article’s conclusions could be tightened into actual investment advice for a particular orchestra by performing the statistical analysis mentioned in this paper with that orchestra’s data or the data of a small group of orchestras of similar size, financial conditions, and region.

Since an appropriate set of tactics makes substantial potential returns possible, this analysis holds real promise for orchestras and needs to be done.

General Strategies for Demand Expansion

The question remains as to whether, beyond the specific tactics suggested, any general strategies can be identified to elicit greater demand for an orchestra’s products. Recent literature in economics suggests that such strategies can be identified; two that will be discussed here are also described in Brooks [ 1997a]. The Veblenian strategy focuses on drawing consumers by enhancing the luxury image of a product. The Marshal/ian strategy tries to “hook” new consumers by addicting them to great music.

The Veblenian strategy is named for the famous turn-of-the-century American economist Thorstein Veblen, author of The Theory of the Leisure Class [I 899]. The approach exploits characteristics of what Veblen defined as a “luxury” (which the intangible and tangible products discussed here possess in abundance) in order to stimulate consumer demand. The reasoning becomes immediately apparent on reviewing Veblen’s own words: “Conspicuous consumption of valuable goods is a means of reputability to the gentleman of leisure” [p. 7 5]. That is, a good which fits at least one role of a luxury-its consumption associates one with the “leisure class” -should be valuable and consumable in public.

Does the first intangible product (the benefits of being a donor) fit this description?

Obviously, philanthropy can be costly, and the more costly it is, the more publicly it tends to take place: the names of “Angels” always appear at the top of the list of contributors. What about the tangible product? For this, add another Veblenian characteristic of a luxury good:

The point of material difference between machine-made goods and the hand-wrought goods which serve the same purpose is, ordinarily, that the former serve their purpose more adequately... This does not save them from disesteem and depreciation, for they fall far short under the test of honorific waste. Hand labour is a more wasteful method of production; hence the goods turned out by this method are more serviceable for the purpose of pecuniary reputability ... [p I 59]

A live concert is consumed publicly, and can be quite expensive. When compared(in strict terms of efficiency of the dissemination of music) with a compact disc, a concert fulfills this third criterion-apparent wastefulness-as well.

The Veblenian approach is now very clear: enhance the luxury status of consumption of concerts and giving. How? Again, to quote Veblen:

A specific formal observance can under no circumstances maintain itself in force if with the lapse in time or on its transmission to a lower pecuniary class it is found to run counter to the ultimate ground of decency among civilised peoples, namely, serviceability for the purpose of invidious comparison in pecuniary success. [p I 05)

That is, associate the products as much as possible with the upper classes, so that enjoyment of them construes membership. In this way, those who desire to be seen as occupying high social rank will gravitate toward the consumption of the orchestra’s services; demand will increase. Linda Sanders [1996] sums up the Veblenian allure well when she refers to “superior music for superior people.”

The Marshallian approach, named for the British economist Alfred Marshall, involves a very different focus: increasing the number of consumers of orchestra services for “pure” reasons-those having to do with the music itself. Aside from improving the music, how might orchestras undertake this approach? A clue from

Marshall ‘s Principles, Book Ill [1938]:

It is therefore no exception to the law [of diminishing marginal utility} that the more good music a man hears, the stronger his taste for it is likely to become; that avarice and ambition are often insatiable; or that the virtue of cleanliness and the vice of drunkenness alike grow on what they feed upon. [p 94]

This suggests that exposure to good music results in self-perpetuating increases in the amount of music that consumers demand, as people become “addicted” to it. The strategy would be to expose people who haven’t experienced orchestral music before to its benefits. These people will in turn want to attend more and more concerts on their own.

Obviously, these two approaches to expanding demand are very different from one another. Can they be pursued simultaneously? The answer depends on the extent to which exposure of new audiences to orchestral music damages the upper- class image of the orchestra ‘s products. In other words, it’s possible that, for example, filling the concert hall with children in order to expose them to music might reduce the incentive to consume in those who do so primarily for status reasons. With this in mind, it seems reasonable to assume that there is a threshold beyond which the two approaches would be increasingly incompatible.

It was shown earlier that the tools or tactics discussed were not equally effective for all orchestras, depending on their size. A generalization along size lines as well with respect to these strategies can now be made by appealing to a commonsense argument about the way two of the tools, fund raising and advertising, are generally used: fund raising involves the development of “elite philanthropy” (to use the words of Francie Ostrower [ 1995]), which is, by definition, elite. Hence, one might be inclined to consider fund raising to be an inherently Veblenian type of tool. In contrast, advertising (the way it generally has been used recently) is probably more Marshallian: campaigns to publicize the orchestra in such a way as to create new audiences are very common at present.

Far from a watertight mapping of tactics onto strategies, this argument has nevertheless a certain intuitive appeal. In light of the statistical findings presented above, orchestras for whom fund raising is a particularly effective tool-smaller orchestras-should follow a Veblenian (luxury-enhancing) strategy for expanding demand for their products. Conversely, orchestras for whom advertising is effective-larger orchestras-would do well to pursue a more Marshallian (newaudience initiating) strategy.

Summary of Conclusions and Suggestions for Managerial Practice

This paper has reviewed the most recent economics literature improving orchestras’ cost-revenue position through manipulation of consumer behavior. Along the way, four basic questions have been answered:

Q I. Can orchestras impact consumer demand for their products?

Answer: Yes. Research shows statistical evidence of this.

Q2. Can any specific tactics for influencing consumers be identified?

Answer: Expenditures on recording, fund raising, and advertising, if made appropriately to individual orchestras’ circumstances, can be effective. These three are most certainly not the only tools at an orchestra’s disposal; for technical reasons they were chosen to test the first question above. Surely other equally effective tools for expanding demand can be found , such as quality improvements.

Future research towards a more comprehensive list of tools available to orchestras is indicated.

Q3. What general strategies can an orchestra pursue to expand demand for its products?

Answer: Recent work in the field of cultural economics has described two approaches that arts firms, including orchestras, can take to increase demand for their products. A Veblenian strategy emphasizes the orchestra’s products as luxuries, hence implying greater social status for those who consume them; it seeks to improve the “audience quality.” A Marshal/ian strategy tries to get uninitiated consumers “hooked” on the product, figuring once a music lover, always a music lover. The manner of implementation of these two strategies is very differentmaking a concert a luxurious and upper-class event may be antithetical to the kind of broad appeal necessary to attract new concert goers and patrons to the orchestra. Therefore, a “mixed strategy” with a little of each approach may well be self-defeating.

Which strategy is the correct one for a particular orchestra? The answer, as it the case of tactics, is, “It depends.” What it depends on is addressed by the last question.

Q4. How do these tactics and strategies vary in effectiveness based on an orchestras individual characteristics?

Answer: The chief characteristic identified here was size (in terms of budget). Statistical tests outlined in this article indicate that fund raising is particularly effective for smaller orchestras while recording and advertising for the same orchestras are ineffective or even counterproductive. The opposite was true for larger orchestras: advertising and recording expenditures create a large return, while fund raising expenditures don’t pay for themselves.

An argument can be made that the effectiveness of the Veblenian strategy for a particular orchestra can be gauged by the effectiveness of fundraising, and the effectiveness of the Marshallian strategy, by the effectiveness of advertising. A logical conclusion, therefore, is that the Veblenian strategy is more appropriate for smaller orchestras, and the Marshallian, for larger orchestras.

This is not to say that size is the only important characteristic of orchestras in delineating demand-expanding tactics and strategies; size was simply the most apparent factor in the data. Surely other characteristics influence the effectiveness of a tactic or strategy for a particular orchestra. To construct a precise and comprehensive set of policy prescriptions for an individual orchestra, these characteristics would have to be identified by performing an analysis on that orchestras data. This is especially important to do for two reasons. First, it is well-known that in spite of the size groupings made here, orchestras are highly heterogeneous, so industry-wide prescriptions may be of limited precision. Second, the analysis done on this subject shows that it’s not enough just to target demand; this targeting must also be done accurately or the investment made can be rendered useless (or worse).

With the above warnings in mind, I’ll close by reviewing the broad suggestions made in this paper.

I. For smaller orchestras (according to the data studied, orchestras with annual budgets of up to $5 million):

- The best single use of the promotional-investment dollar is probably donor development.

- Concentrating on promoting the luxury image of concerts and patronage is likely to be more fruitful than seeking to expand the audience base into the world of previously uninitiated consumers.

2. For large orchestras (with annual budgets of over $5 million):

- Advertising and perhaps recording are probably better investments than fund raising.

- Concentrating on expanding audience/ patron base with previously uninitiated consumers is likely to be more fruitful than promoting the elite image of orchestra products

Notes

I See Baumol [1996].

2 Instances of this abound. At one recent conference I attended an economist predicated an analysis of musical quality in ensembles on the assumption that higher levels of postsecondary education among musicians was a valid indicator of higher performance ability.

3 See, for example, Brooks 1996, 1997 a, and 1997 b.

4 See U.S. Bureau of the Census [1996].

5 Frank and Cook describe this phenomenon very accessibly in their recent book [1996].

6 This debate is discussed in detail in Throsby [1994].

7 Two observations during the years I made my living as a musician lead me to believe that there is indeed room for improvement on the demand side. First, much demand-side activity is generally not sincere: many in the industry seem to believe that forces of demand for orchestra products is outside orchestras’ control. Second, efforts to increase demand are often targeted haphazardly-small markets apply the same tactics as large markets, for example. As will be shown, this simply does not work.

8 See Brooks [1997b].

9 It should be noted that my treatment of the topic of public subsidies as a direct result of societal demand might appear to ignore a large and convincing literature on the disconnection between bureaucratic action and public will (See, for example, William Niskanen [197 3]). In reality though, this treatment relies only on the contention that the magnitude of state subsidization of the arts in some positive way (however small) correlates with the public ‘s perception of benefits from the arts.

10 This is only true under certain circumstances; specifically, inferences about demand can only be made if product supply is constant. This fact explains the choice of tools tested in upcoming sections.

11 In Brooks [ 1997b] the economic theory underpinning this section is developed in detail.

12 Suggested in a recent article in The Economist [1996] about national orchestral performance styles: “Even the recording industry is helping to dismantle national styles, which might otherwise provide some musical justification for their endless duplication of repertoire.”

13 For one of many examples of such efforts, for example, see Miller [1 996].

14 Inflation was corrected for using the Consumer Price Index.

15 Use of the word “profits” is unrelated to the fact that the vast majority of orchestras are nonprofits. Rather, a change in profit here simply refers to extra revenue earned as the result of an expenditure, minus the expenditure.