No Time At All

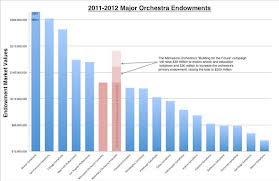

Just like Rip Van Winkle, American orchestras have been asleep for twenty years. Season after season of the same repertoire, played again and again for generations until the idea of an orchestra participating in modern musical life seems outrageous. Last week, the League of American Orchestras focused their annual conference around the idea of “Imagining Orchestras in[…]

Read More

No comments yet.

Add your comment